Welcome to AI Collision 💥,

In today’s collision between AI and our world:

A bit of China, a bit of the US, a bit of the Dutch

Nokia: can anyone catch them?

Is government better with AI? (Poll)

If that’s enough to get the foundry firing, read on…

AI Collision 💥 TSMC’s rise from the ‘87 ashes

As we explained on Tuesday, there are a lot of vocal dissenters about the longevity of the AI boom that we’re experiencing.

Seems like every major investment bank or research house now has a view that this market is primed for a monumental crash and bursting of the “AI bubble”.

Some are saying it’s imminent. Some suggest it’s another two years away. If that’s the case, do you really want to be out of this market for two years in anticipation of a crash or correction?

Even if you had been an investor in October 1987, you’d still be better off long-term sticking in the market than trying to perfectly time when the market corrects or crashes.

(Yes, THAT October 1987, Black Monday.)

Even from the 2008/09 crash, long term, being out of the market is just not a wise decision – and I’ll tell you about a company today that proves exactly why…

And even if the market does correct or crash, not only does this provide great chances to pick up cheap stocks, but it also often opens the door for something great to emerge from the depths of investor despair.

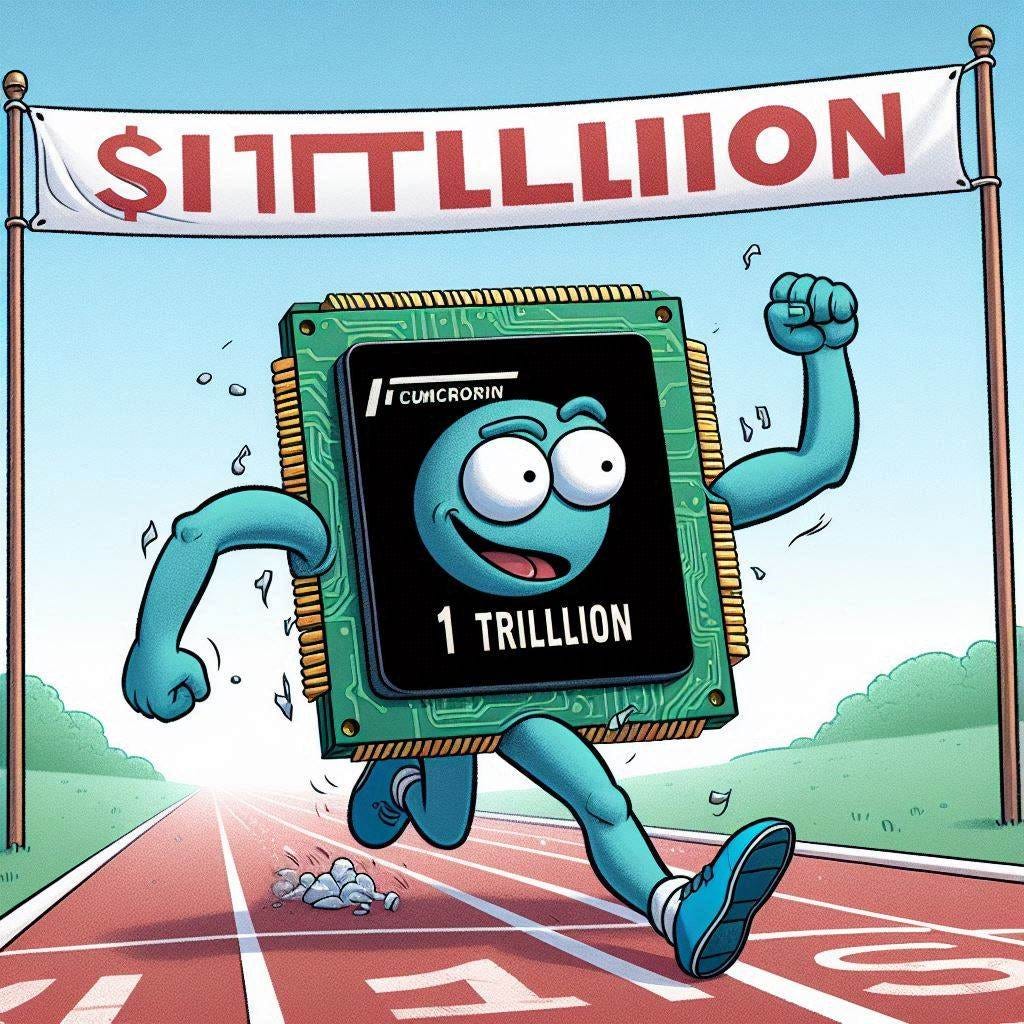

In fact, if we wind back to 1987, the same year of “Black Monday” we’ll find the origins of what’s most likely about to become another regular member of the $1 trillion club.

After plying his trade at Sylvania Semiconductor and then a highly successful stint at Texas Instruments (NASDAQ:TXN) Dr. Morris Chang was tapped on the shoulder in 1985 by the Taiwanese government to head up what was to be the Industrial Technology Research Institute (ITRI).

Two years later, whilst still at ITRI, Chang would also start a company involved in semiconductor manufacturing called Taiwan Semiconductor Manufacturing Company.

Thanks to his leadership and expertise in this area, he was promptly backed by the Taiwanese government and also multinational Dutch technology company Philips.

As an investor and early customer, Philips was crucial to TSMC getting off the ground. Also, its business model of making chips, with no interest in designing them, made a lot of sense to Philips and others early on.

TSMC would go on to become the preeminent chip maker for all kinds of tech companies around the world. Today some of its biggest customers include Nvidia, Apple, AMD, MediaTek, Qualcomm and Broadcom.

It’s also been a publicly listed company for 27 years. Its initial public offering (IPO) in 1997 saw the stock list at $24.78. Stock split adjusted, that’s an IPO price of a bit over $5. With a stock price today of around $190, that’s over 3,500% in 27 years – or about 14.5% compounding annually every, single, year.

But what’s significant about that isn’t just the extraordinary returns over that time frame. It’s the fact that having briefly crossed over the $1 trillion mark just this week, it looks like TSMC is going to leapfrog into the esteemed $1 trillion club and stay there.

TSMC reports earnings next week – and we’ll have more in the coming weeks about the big AI and tech players that are reporting soon. As we noted the other day, we’re expecting them to beat expectations.

Now the stock may well run up in anticipation of that – not just cruising through $1 trillion market cap, but smashing past it. It is crucial to the rollout of AI. And as the biggest actual maker of chips needed for AI worldwide, it’s fair to say as important as a company like Nvidia might be, you cannot ignore the company that makes most of its stuff either.

TSMC is an example of regardless of the bump, crises and crashes and corrections in a market, in the long term, quality companies that do really important things can be absolute stars and winners in a portfolio.

AI gone wild 🤪 it’s tough at the top

I saw this last week. It’s not the first time I’ve seen it. It probably won’t be the last.

We were all there in 2007, in the midst of Nokia mania. By this stage, I was rocking a Nokia N73.

It wasn’t my first Nokia, nor my favourite. That title went to my old bright orange Nokia 5210. I tested out its “rugged” capabilities by dropping it (intentionally) on a brick and then submerging it in a pint of beer when I first got it.

I also had the Nokia 3210. But then again, who didn’t have that one? The 3210 shipped over 160 million units worldwide.

I had some others even as recently as the Nokia 6300 when one Xmas I decided I wanted to go “off grid”. I also pined for many more including the N-Gage, the 6810 and N90. But for decades, nothing was better than Nokia.

Note; I’d love to hear about your favourite Nokia phone, or the Nokia you fell in love with most during their time at the top. Let me know in the comments…

Even today as far as sitting on the precipice of design, nothing really has ever come close to Nokia.

But I bring all this up today because of that Forbes front page and its relation to AI comes amid all this talk of AI “bubbles”.

There is no doubt in my mind that AI is with us to stay. It is no bubble if the technology itself will form a fundamental part of all technology into our future.

What might be bubble-like are the key players in the AI space. For now, at least, I don’t see the top of the tree changing at all. I don’t see how Nvidia and AMD suddenly drop off the perch – not at this point at least.

But we must always appreciate that when you do sit on that throne – as strong and mighty and all-encompassing as it might seem at the time – competition, new technology, someone who just figures out how to do it better can and do regularly come along to disrupt and dominate.

Take nothing for granted. Nokia was the king of its domain for decades. And it did seem like no one could or would catch Nokia. Until they did.

The same could be said for the kings of AI today. Just a reminder, to always keep a look out for what comes next wherever it may come from.

Boomers & Busters 💰

AI and AI-related stocks moving and shaking up the markets this week. (All performance data below over the rolling week).

Boom 📈

Veritone (NASDAQ:VERI) up 25%

Tesla (NASDAQ:TSLA) up 14%

AMD (NASDAQ:AMD) up 12%

Bust 📉

Brainchip (ASX:BRN) down 8%

WISeKey International (NASDAQ:WKEY) down 8%

UIPath (NASDAQ:PATH) down 8%

From the hive mind 🧠

As a parent there’s enough things you worry about with your kids, let alone the perils of AI. But now you’ve got to think about how to teach your kids responsible use of AI, otherwise it might lead to some serious jail time.

Former colleague of mine John Stepek writes a very entertaining column over at Bloomberg. And in his latest one, like we’ve done this week, he looks at how to invest in AI in conditions that many consider to be a bubble.

I’m going to answer the question the BBC poses in this headline succinctly and nice and easy for you… YES!

Artificial Polltelligence 🗳️ The Results

Following on from our last link above in the “Hive Mind” section and following on from the new government that has formed in the UK this week, I want to know your thoughts on dealing with government services and AI.

Weirdest AI image of the day

Forbidden love – r/Weirddallee

ChatGPT’s random quote of the day

“We must be willing to let go of the life we planned so as to have the life that is waiting for us.” — Joseph Campbell

Thanks for reading, and don’t forget to leave comments and questions below,

It certainly couldn’t get any worse.

When discussing the election and potential uses of AI by future Government depts, I suddenly thought AI could potentially replace the Chancellor, and produce budgets, based on data and intelligence rather than ideological theories. Would be an interesting 3xperiment if nothing else.